Investing for Tomorrow: Why Teaching the Next Generation About Crypto (and Beyond) Matters

Investing for Tomorrow: Why Teaching the Next Generation About Crypto (and Beyond) Matters

The conversation about money is changing, starting earlier than ever. Some 10-year-olds already know more about Bitcoin than most adults did a decade ago. They understand that money isn’t just notes and coins, and that the world of investing now includes digital assets alongside shares, property, and superannuation. They also love Doge & Pepe too because, much as you try, you can’t stop those memes from penetrating the pop culture, but that’s another story!

The point is, though, they are very across it - even more so than many 14 or 16 year olds because they are growing up around it. Kinda crazy!

But if we look at today’s younger generation - pre-teen, teens, young adults, and couples, taking their first steps toward building a nest egg, crypto isn’t a fringe idea; it’s becoming part of their mainstream investment conversation. And that’s why starting these conversations early matters:

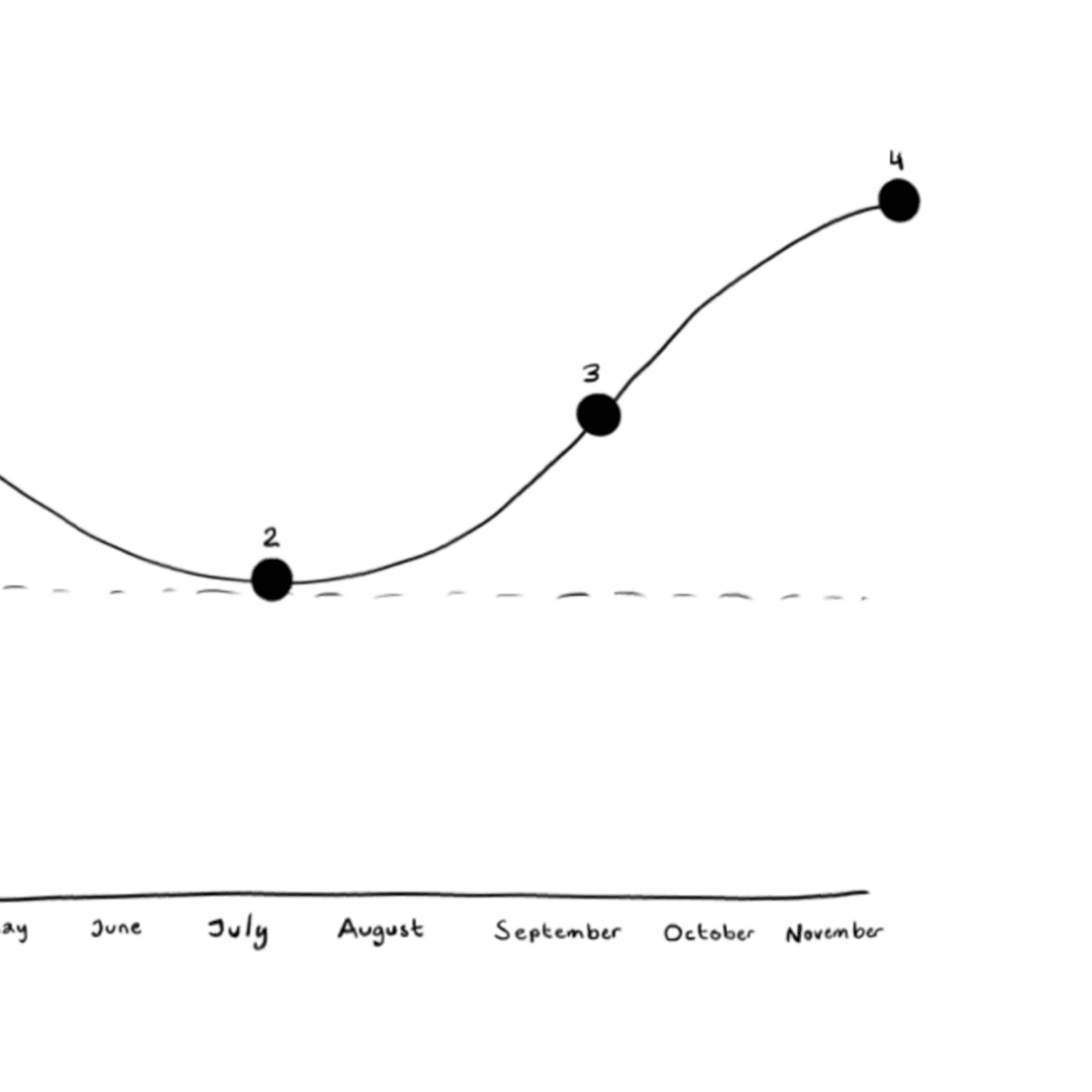

- Growth works best with time on your side. For example, let’s calculate what happens if you were to invest $50 per week in Bitcoin using Bamboo for your 15-year-old child, and the investment grows until the child turns 18 (so, over 3 years).

Using a modest 30% return, it would look like this:

- Total invested: $7,800

- Estimated value at age 18: $12,58

- Growth gained: $4,780

That’s a pretty impressive way to educate and help them save for a first car.

-

Financial literacy builds confidence. Understanding different asset types from ETFs to Bitcoin means they’re more likely to make intentional, informed choices rather than reacting to hype or fear. Taking the emotion out of saving and investing now helps break those generational cycles, too!

-

The world they inherit will look different. Digital assets are already part of major investment funds, retirement accounts, and government discussions. Knowing how they work will be as essential as reading a bank statement or lodging a tax return.

-

Diversification is protection. A young couple saving for a house might keep most of their investment in cash and low-risk assets, but a small, steady crypto allocation could provide extra growth potential over time.

The key for young investors is balance. Crypto isn’t about betting the house, or going all in, it’s about being part of a well-structured, consistent plan - like learning how to Dollar Cost Average!

Rather than just telling them about crypto, teach them about it. Giving them an early seat at the table is a gift worth giving. In a future where digital and traditional investments work together to build stability and opportunity, grasping the basics is the best building block they can have, the earlier the better.

This week on the podcast, we’re joined by Jonno Newman, author of Bitcoin Minors, a book dedicated to helping young people understand the opportunity and responsibility of investing in crypto. His approach strips away the jargon, focuses on practical steps, and reminds us that the goal isn’t just to make money, it’s to create a financial foundation that lasts.

Because the truth is, the decisions we make today and the education we give our kids will shape their wealth, freedom, and security of tomorrow. And that’s a conversation worth starting now. 🌱

Active vs Passive Investing: What's the Difference

Why Craig continues to buy regardless of the market

Dollar-Cost Averaging 101

The latest crypto news delivered straight to your inbox.

Subscribe to our newsletter